Cision’s Insights team recently looked at how 2022 summer sales events influence the holiday trends – and what it could means for brands

In effort to better understand the influence Amazon Prime Day had on the retail landscape, Cision’s Insights team analyzed media coverage mentioning the Fortune 100 U.S. retailers (which includes the top 100 companies listed in Fortune magazine’s 2022 retail ranking of the 500 largest U.S. corporations by revenue) from the beginning of May to mid-July.

The findings provide a snapshot of the impact the two-day event has on the retail industry overall as well as insight into how brands can prepare for their upcoming holiday marketing communications and PR efforts.

Summer Sale News Cycle: New and Notable Trends for PR Pros to Know

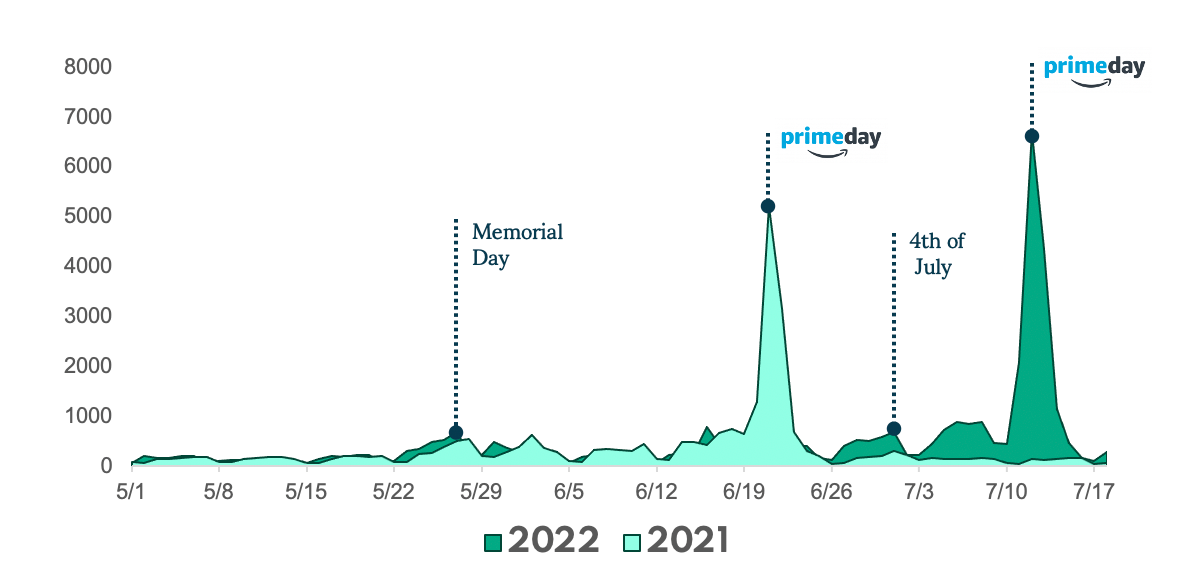

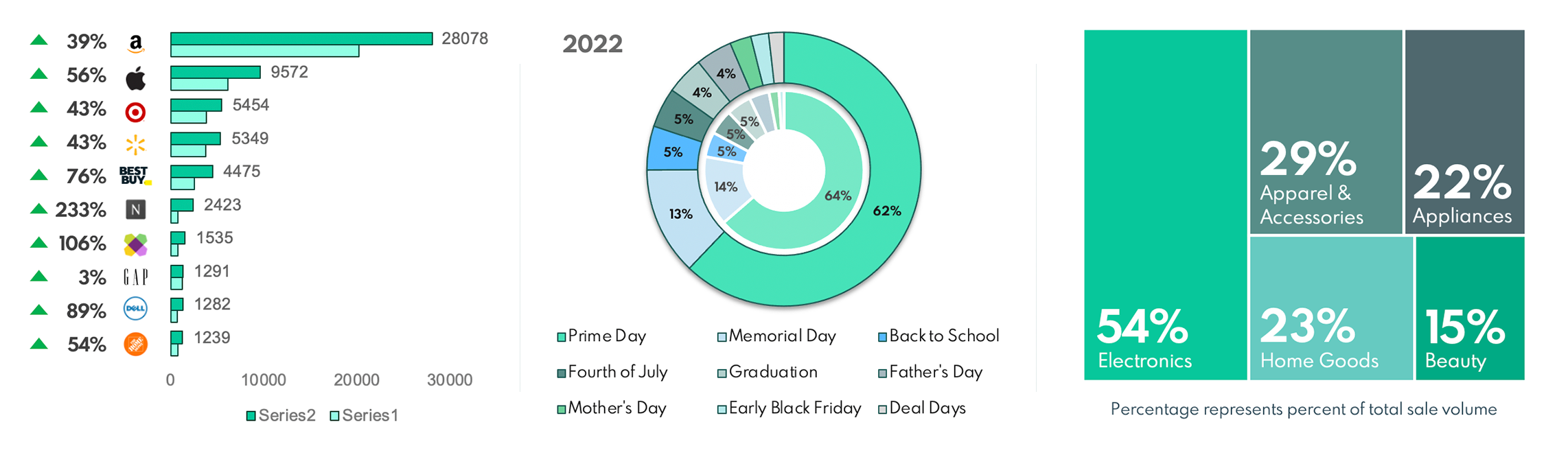

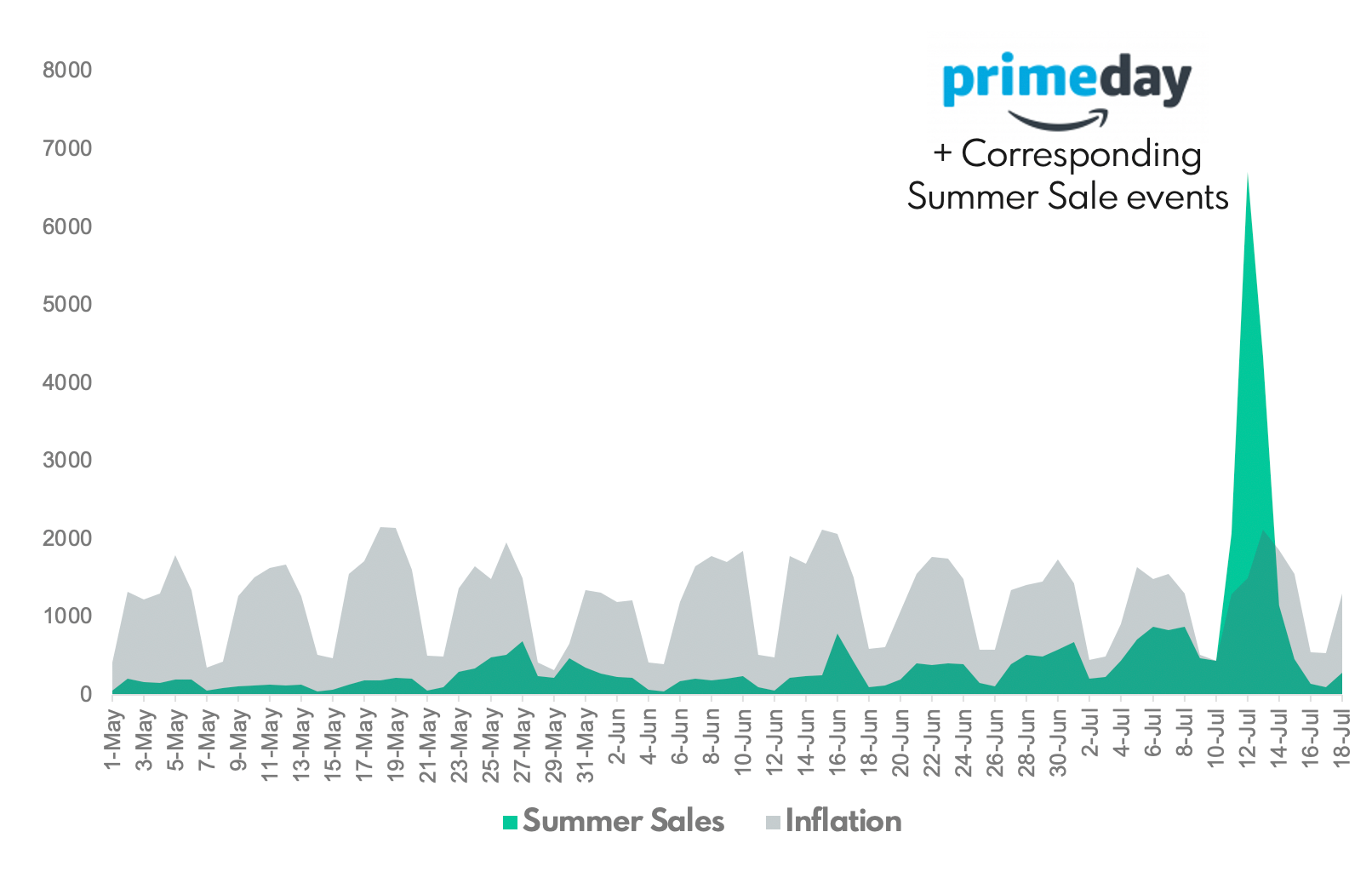

The finding: It’s not unusual to see a surge in news coverage around summer sales as back-to-school season approaches. These spikes have seen consistent growth over the years with the biggest buzz of all around Amazon Prime Day. The famous sales event once again dominated the Fortune 100 retail summer sale news cycle – with over 60% of share of voice – and generated the most significant single-day surges, it has become the sales event of the season It also fueled the most total articles across summer events.

Hot topics & key trends: Electronics deals reigned supreme during the time period – and were up 32% year over year (YoY); however, Cision’s Insights team also saw significant jumps in coverage for key merchandising categories including apparel, home, appliances and beauty. Fulfillment was also a prevalent topic of conversation, as well as inflation, supply chain logistics and inventory concerns.

It’s also worth mentioning that influencer marketing helped to amplify the sales news and events. The emergence of platforms like TikTok and increased link-ability have elevated influencer marketing even more of late, enabling brands (via influencers) to reach wider audiences to make recommended purchases in the single click of a button.

Brand Visibility: Amazon wasn’t the only benefactor in the summer sale news spike: All top 10 Fortune 100 Retailers saw YoY growth. Many Fortune 100 retailers saw increased visibility from 2021: Lowe's (up 295%), Nordstrom (up 223%), Lululemon (up 186%), 7-Eleven (up 137%), and Wayfair (up 106%) led the way in YOY growth.

Key Sale Events: After Prime Day, the summer sales events that saw the most substantial YOY growth in coverage included Memorial Day (up 34%), Back-to-School (up 50%) and mentions of Black Friday/Christmas in July (up 291%).

Key Sale Categories: While media coverage around electronics sales typically generates the most volume during this time period, beauty saw the most substantial YoY gains (up 71%) – a trend that emerged during the 2021 Holiday season. Other notable jumps were a 56% increase in home sale event news and a 41% increase in apparel and accessories.

Inflation Concerns and Impact Leading Into Holiday 2022

CIsion’s data indicates that inflation remains an emergent and consistent trend throughout 2022. Throughout May until mid-July, Fortune 100 retailers produced over 97K articles and generated over 6M social shares related to inflation. Inflation narratives appeared in 10% of total volume of Fortune 100 retailer mentions (compared to 3% for Summer Sales narratives). Rising cost speculation will only likely increase as consumers head into the influential holiday season.

Despite overall inflation concerns, Amazon reported its ‘biggest’ Prime Day yet, citing 300 million items sold. Home goods, consumer electronics and Amazon-branded devices were the top-selling categories. Additionally, multiple retailers hosted competing Prime Day sales, including Target, Best Buy and Kohl’s. (According to CNBC, online retail sales in the U.S. during the Prime Day event surpassed $11.9 billion – 8.5% higher than overall e-commerce transactions generated during last year’s event.)

Inflation has influenced over 10% of total Fortune 100 retailer volume within the period, while Summer Sales events drove 3% of volume.

7 Takeaways for Brands and Their PR Teams

Based on this data, here are some tips from our expert Cision Insights analysts for your teams to consider to better inform your marketing efforts moving into the holiday season

- Get in early: Historically, analyst guidance has urged consumers to purchase big-ticket items during Black Friday. However, with each passing Summer Sale Cycle, it is clear consumers aren’t waiting for the winter holidays to purchase items from their wish lists. If supply chain logistics are a concern for customer experience, kickoff your holiday sales early.

- Own your narrative authentically: With continued speculation surrounding inflation and an impending recession, be transparent about your holiday strategy. Leverage impactful CEOs and spokespeople to ease consumers’ minds. Communicate expectations clearly and concisely.

- Emphasize fulfillment options: Not every retailer can own its own fleet of delivery trucks, but it is essential to have a trusted fulfillment process that is easy and safe for guests. Partner with trusted sources, offer curbside-pickup. Free delivery is always enticing, but transparency is essential. Develop clear key messages surrounding delivery options.

- Differentiate yourself: Consumers know Amazon isn’t the only game in town. Prime Day dominates the summer sale news cycle but has seen increased competition over the last four years as retailers like Target, Kohl’s, Best Buy and more host competing sales. Competitor sales leveraged “no membership” key messaging within their sale narratives to differentiate themselves from subscription-based Prime. Walmart opted to host Walmart roll-up sales throughout the summer, rather than going head-to-head with Prime Day market share. Clearly communicate your exclusive guest perks.

- Know what sells: Retail media saw a renewed emphasis on beauty products within sale events, a trend that will likely continue; however, other product categories made significant waves during the summer sales period as well. Staying ahead of the consumer trends and the interests of your target audience will help inform your own messaging.

- Partner up: Traditional news saw an increase in influencer marketing partnerships, which helped amplify coverage around various sales events. Consider partnering with or reaching out to influencers who fit your brand and are aligned with what it stands for.

For additional expert insights

The above analysis is just one example of the type of curated reporting Cision’s Insights team pulls for brands and organizations across industry and size every day. PR, Comms and executive leadership teams rely on our combination of industry analytics and human qualitative research to get the intel they need to make key marketing decisions that have real business impact.