Cision and PRWeek have joined forces for the seventh consecutive year to collaborate on the 2024 Global Comms Report, a deep dive into an industry that’s rapidly changing how it operates (and how success is measured), thanks largely to the emergence of new digital technology and platforms such as generative AI.

For this year’s report, we surveyed more than 400 industry professionals across 10 countries to get a snapshot of how the PR and comms world has shifted over the last 12 months. Yet across the regions covered – United States, Europe and APAC – there are notable differences around how comminutions professionals responded.

We’ve sifted through the survey results to understand the biggest differences and similarities in how communications teams operate around the world and why it matters.

1. The Biggest Challenges and Top Concerns

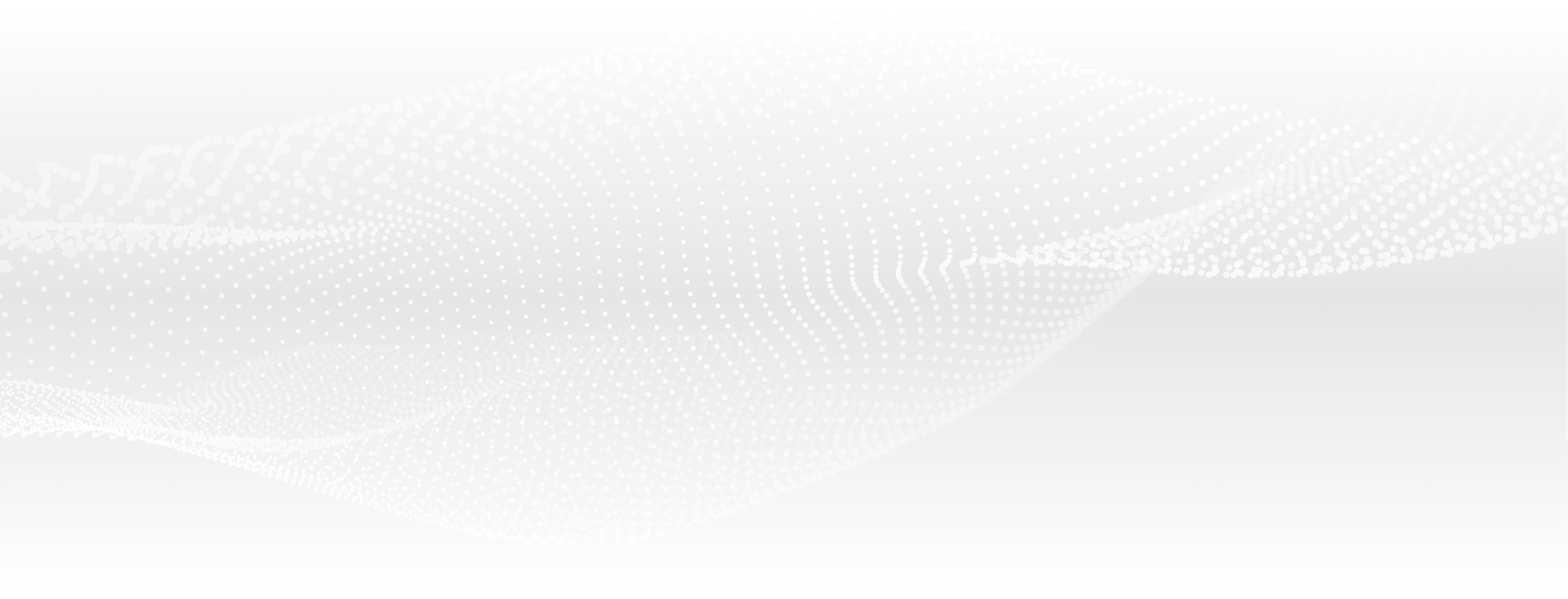

Global Comms Report respondents were asked to choose four factor (from 13 options) that they feel challenge their comms efforts the most. Worldwide the “inability to measure impact effectively” was chosen by 50% of respondents putting it top as the biggest global challenge, however digging into the regional data tells a different story.

From the figures below, it’s clear that “ability to identify and invest in the best tools for my team” is the biggest challenge in both Europe and APAC (at 61% and 63% respectively), but it only registers at 28% from U.S. respondents. Of greater concern for U.S. PRs is the need to secure appropriate budgets (at 60%).

On the theme of measuring PR’s impact, while 32% globally revealed that their teams had at least one dedicated data analyst, there’s a notable gulf between the number of U.S. respondents who said they did (16%) and those in Europe (79%) and APAC (88%).

2. Social Media Preferences and Popularity

Deciding what social media channels to prioritise are hugely important for a brand’s overall strategy – particularly for comms teams with limited resources. Targeting platforms that will resonate the most with your target audiences is paramount.

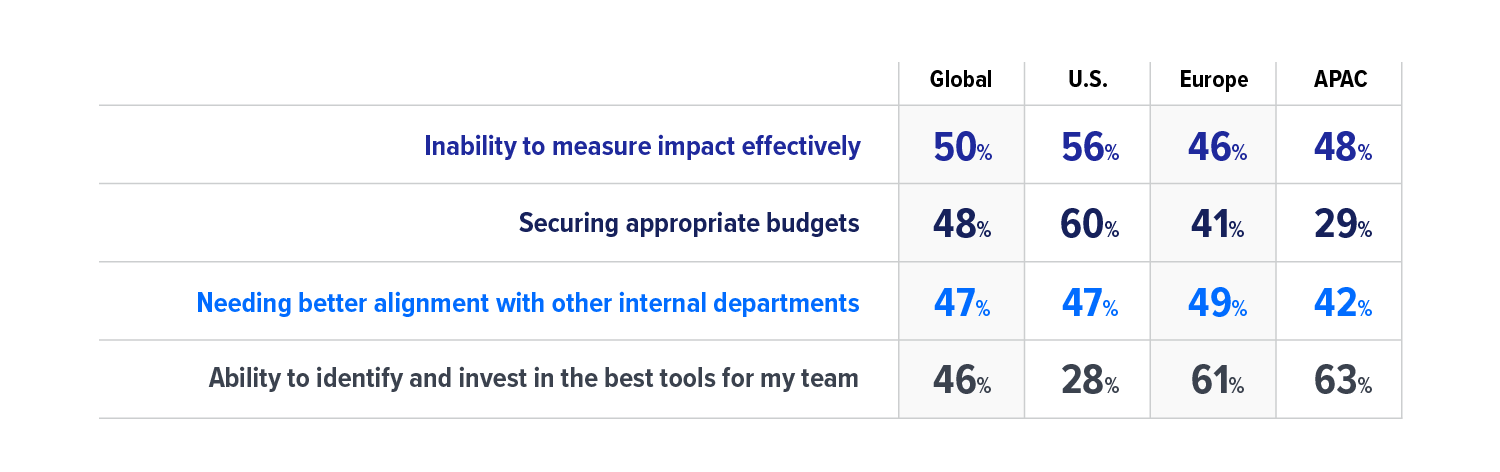

In this year’s Global Comms Report, respondents were asked to choose the four platforms (out of 10) they deem most valuable to their broader content strategy. Globally, Facebook (73%), Instagram (71%), LinkedIn (67%), and YouTube (52%) came out on top, with X (formerly Twitter) in fourth place.

Breaking down the social media responses by region, Facebook sits in first place in both APAC and Europe, but in the U.S., LinkedIn claims the number one spot. As seen in the data below, the APAC region finds TikTok and WeChat in the top four, but these platforms aren’t gaining as much traction elsewhere.

It’s also worth noting that when the Global Comms Report began in 2017, Facebook was by far the top choice in every region. That’s no longer the case as more social platforms emerge, leading to greater audience fragmentation.

3. “Everyday Consumers” Are the Most Effective Influencers

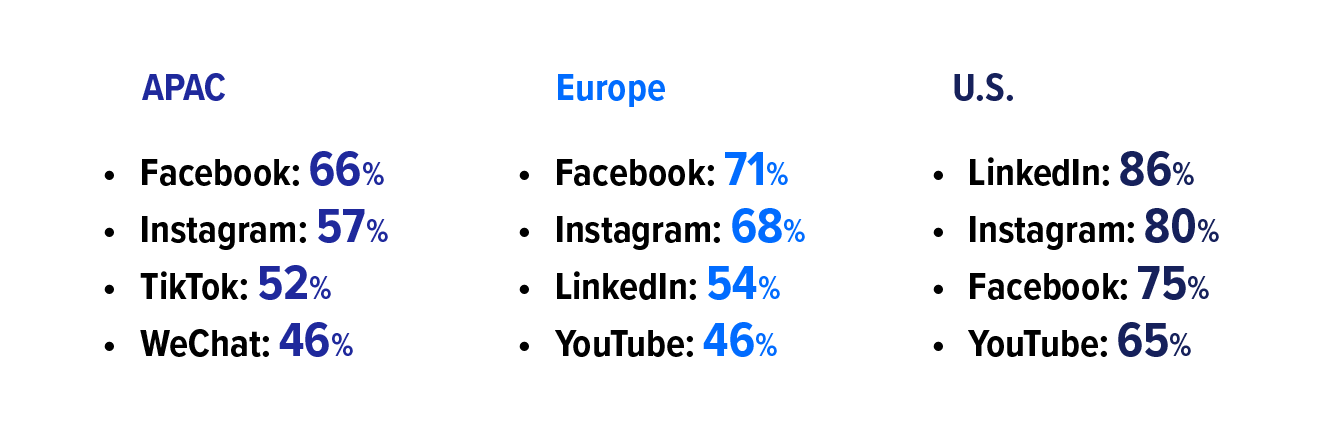

For the 2024 Global Comms Report we presented our respondents with seven types of influencers and asked them to rank them from most to least impactful for their communication strategies. The results showed that “everyday consumers” had the power to persuade globally, with Europe and APAC ranking them the top type of influencer.

In the U.S., however, everyday consumers were ranked third, with the top spot going to “niche or micro-influencers”, followed closely by journalists. Trust in the press may still be solid in the U.S., but the same can’t be said in Europe and APAC, where journalists rank sixth and seventh, respectively.

One finding is consistent across the board: Celebrities are not deemed to be among the most influential with consumers. Globally and in the U.S., they placed last, while in Europe they were fourth and in APAC fifth.

A further breakdown of the influencers by region can be seen below. Note: Percentages indicate how many respondents placed that influencer among their top three.

4. Crisis Preparedness and Prevention

Crisis management remains a key disciple of the PR and comms profession, and with myriad monitoring tools now at teams’ disposal, they are well placed to respond to and manage crises.

This is reflected in the Global Comms Report survey, where 77% of global respondents said they had “the necessary tools to optimally manage crises for your company/the brands you work with.” Breaking this down by region, Europe responded most confidently to the question with 85% answering affirmatively, with APAC at 83% and the U.S. on 68%.

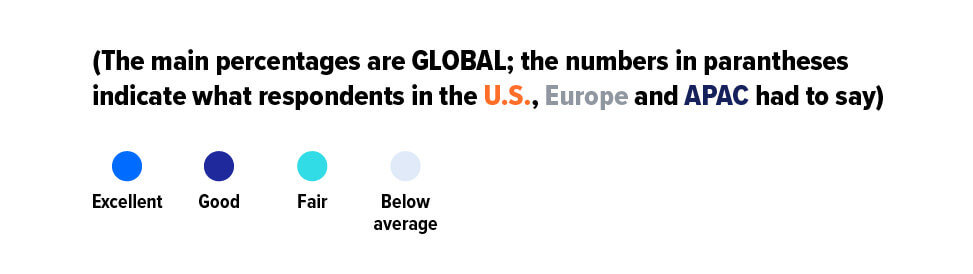

When it comes to prevention, respondents were asked to rate their ability to stop a crisis unfolding as “excellent”, “good”, “fair”, or “below average”, just 21% globally said “excellent”. In the U.S., only 12% of those surveyed responded with “excellent”, with Europe registering 28% and APAC 29%.

The takeaway? PR pros feel they are equipped with right the tools for the job but are still in pursuit of crisis response and prevention excellence. More regional data can be seen in the chart below.

5. Use and Adoption of Generative AI

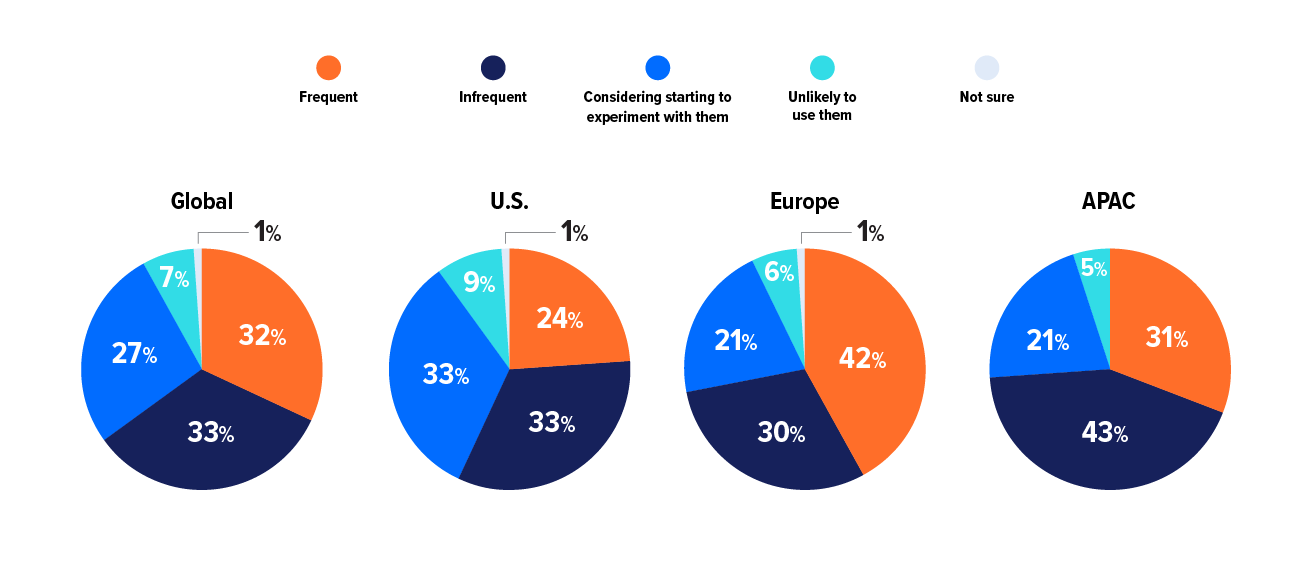

Since our last Global Comms Report, the emergence of ChatGPT has put generative AI in the spotlight. However, the data below (reflecting the current use of generative AI tools among respondents) shows that those in the U.S. are yet to adopt the technology with the frequency of their European or APAC counterparts. In fact, Europe leads the way with 42% of respondents saying they use generative AI “frequently”.

Of the potential use cases for generative AI, the most popular among our global respondents was research, where 42% said they were “experimenting with generative AI, but not using it with any regularity.” Here, the U.S. registered 46%, Europe 33%, and APAC 48%.

These responses are an indication that the PR and comms industry is still in a discovery phase when it comes to generative AI. There’s no widespread adoption yet, but this data could change by the time the 2025 Global Comms Report comes around.

Key Takeaway

This data from the Global Comms Report illustrates how the media landscape can vary by region, in some cases significantly. For PR teams operating on a global scale, having an understanding of the dominant channels, preferred communication platforms, and media consumption habits worldwide is critical for creating effective, nuanced strategies. PR teams must be diligent in ensuring they are staying ahead of these trends with in-depth media monitoring and industry insights, and optimizing their strategies accordingly.

To learn more about how the comms landscape is evolving across the U.S., Europe and APAC, read the full 2024 Global Comms Report.

To learn about the solutions available to help you apply these findings to your comms strategy, speak to one of our experts.