There are three main categories of media:

OWNED: Content your brand creates, such as your website or your social channels.

PAID: Content your brand spends money on, such as a display ad or sponsored content.

EARNED: Content your brand did not create or pay for, such as a review or article.

Real-life example: You’re craving a cup of coffee. Which do you trust?

OWNED: A café’s website and app proclaim “We pour the BEST cup of coffee!”

PAID: A web banner or billboard advertises “Come in and try the BEST cup of coffee!”

EARNED: A review or article states “This was by far the BEST cup of coffee I’ve had!”

Naturally Earned Media is the most trusted of the three, and Nielsen data backs this up. However, Earned Media has also been the most difficult to measure. Until now.

Monitoring the web for Earned Media coverage is table stakes – of course it’s important to hear what’s being said and by whom, but we’ve graduated to a more advanced level of knowledge. The below strategies could be applied regardless of where you acquire data— however, only Cision Impact can provide this extent of reach, audience, and conversion data on Earned Media. (wink!)

One final note before we dive in. I’ve heard that “Comparison is the Thief of Joy” ... that’s a great mantra concerning your material belongings or your appearance, but it’s the opposite when looking at data. To me, Comparison is a Reason for Joy. Without having some sort of benchmark (ahem, comparison) your data creeps closer to vanity metrics.

Reach

First, brands should know the reach of their Earned Media coverage by individual humans, not something as broad as “potential reach” or UVPM. By tracking user cookies across the web it is possible to know how many validated eyeballs have read your coverage.

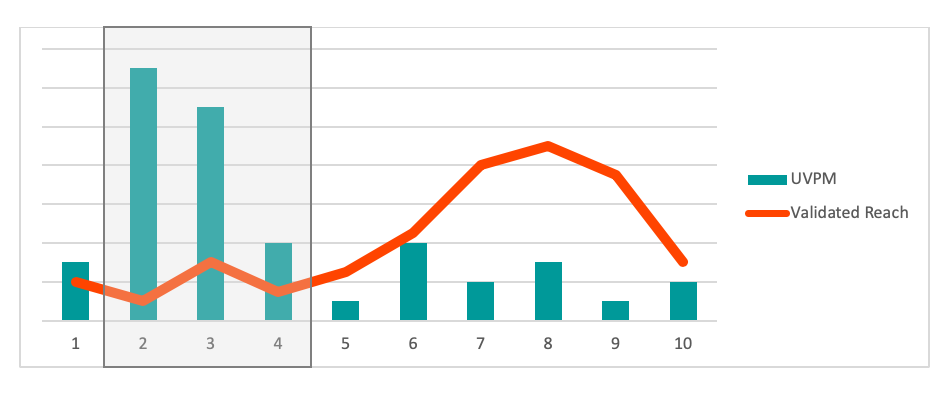

This example examines the reach and UVPM of an event-specific search, with the event timeframe highlighted:

The UVPM hit a huge spike during the event to no surprise – this is when multiple articles and announcements were published. However, the buzz and viewership didn’t truly skyrocket until after the event ended. Without knowing validated reach numbers, this PR team would have assumed the max viewers occurred on the first day of the event.

Audience

Second, brands should know the audience of this Earned Media coverage and be able to break them down by demographics and firmographics, at a minimum. Of those validated eyeballs it is possible to know how many fit your target persona or ideal customer profile (ICP).

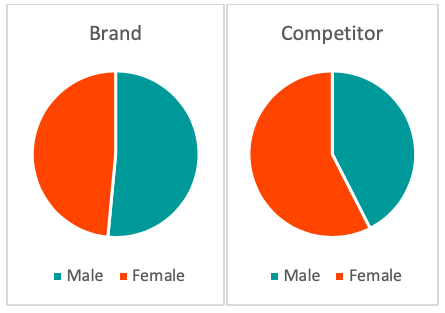

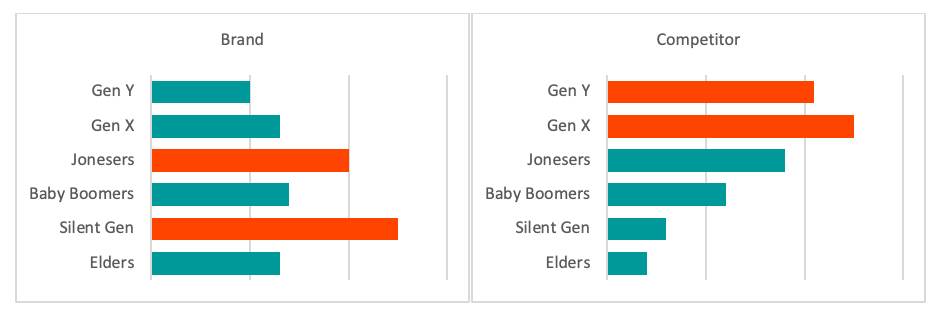

Take a look at this search’s audience, comparing a brand’s coverage to that of a competitor:

The brand’s coverage is more male-dominated with a skew towards older generations. However, if we look at their main competitor’s earned media coverage, we can see the emphasis on a younger and female-skewed audience. This provides the PR team with insights on who they’re missing and why their competitor is stealing market share; they can now adjust their messaging and pitching accordingly.

Results

Third, brands should know the results of this Earned Media coverage by tracking conversions from earned media content to their website. Attribution will not always be direct; consider someone who reads an article and doesn’t end up landing on your website until a few weeks later. PR should still get this recognition.

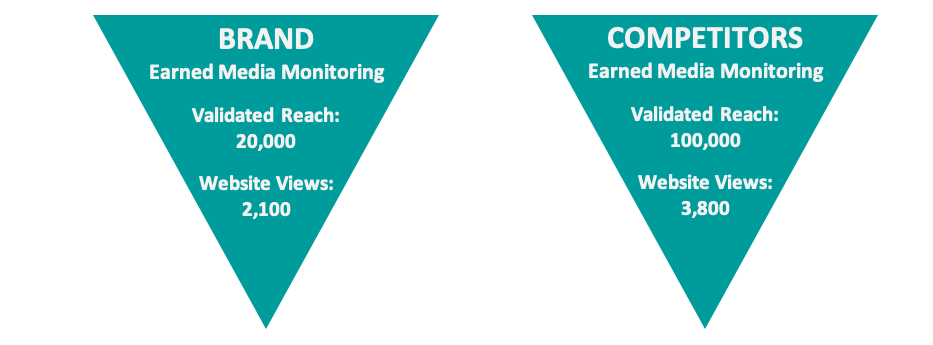

Here is an example from both a company’s own brand search and a search specific to their top three competitors:

Obviously, their brand’s earned media coverage is performing very well – we can see almost an 11% conversion rate from an individual reading earned media content to visiting the brand’s website (hint: the average click-through rate for emails is 3.57% and for display ads is 0.35%). What’s even more interesting is this: in a search solely focused on this brand’s competitors, we are still seeing 4% of this audience convert to their website. Imagine if you could prove that 4% of individuals who read an article mentioning your competitor have visited one of your own company web pages!

As you strategize between your Owned, Paid, and Earned media for the upcoming year, consider how your teams are measuring each item. Owned websites and Paid media are extremely easy to measure and have been for at least the past decade... but if Earned media is the most influential, why isn’t your brand measuring its success?

Cision is the leader in Earned Media Measurement.